Financial Planning Tips for 2021

- Steve Cage

- Dec, 21

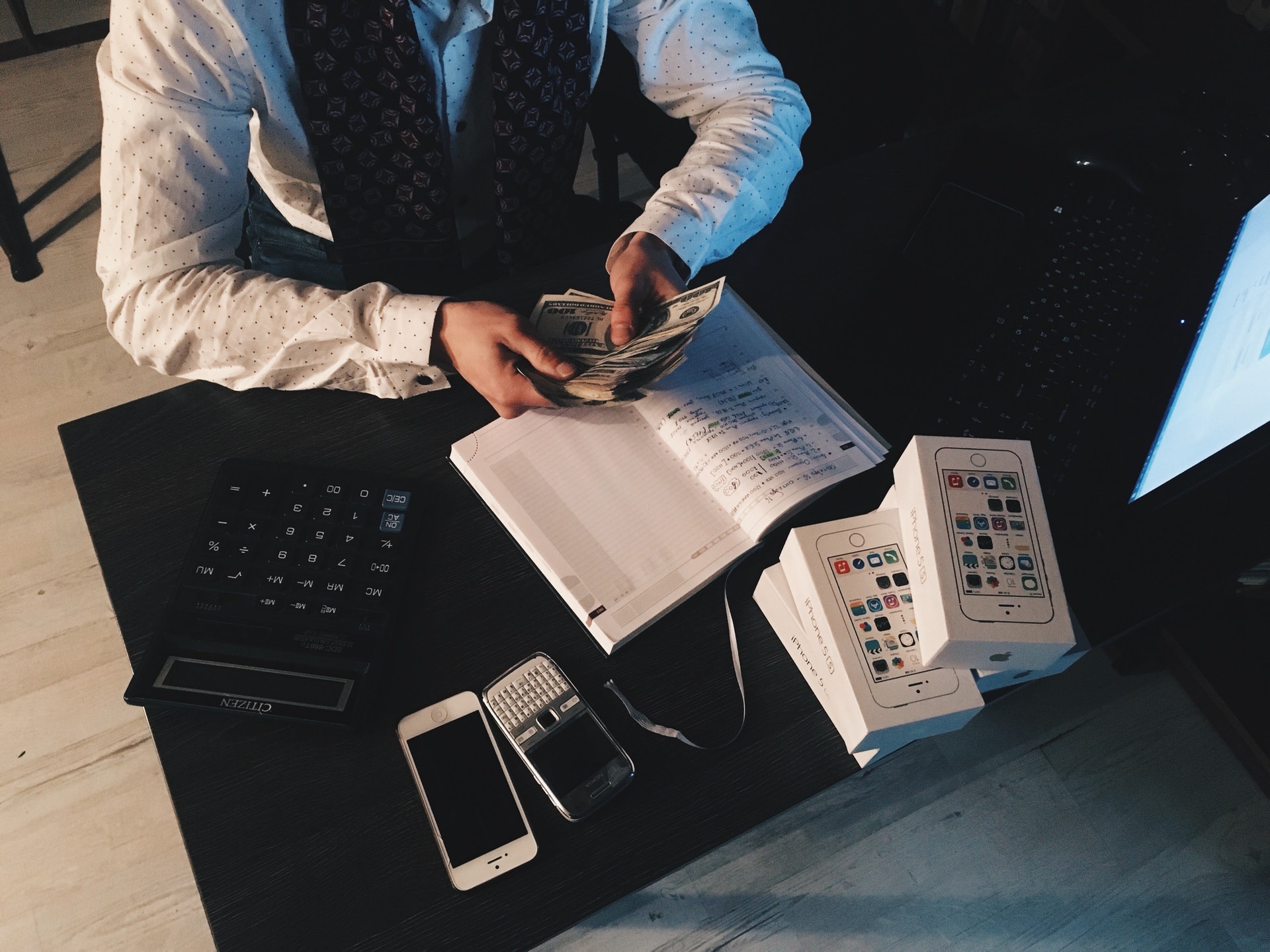

2020 was a chaotic year for most people. Even if you started the year with a fantastic plan for financial success, there’s a good chance that you ended up losing track somewhere along the way. Many people had to suddenly switch up their budgets when dealing with the new realities of things like fewer hours at work, and furlough demands. Fortunately, even if you didn’t have the best year in 2020, that doesn’t mean that you can’t improve your chances of success for 2021. Let’s look at some of the financial planning tips you can keep in mind as you head into the new year.

Create a New Budget

A lot of things can change over a year. There’s a good chance that your budgetary needs going into 2021 aren’t going to be the same as the requirements you had the year before. To ensure that you know how much cash you have to spend on essential things like investments and savings, start by creating a new budget. Sit down and look at all of your incoming money and outgoing expenses. Are there any new commitments that you have to worry about now? Have you found additional sources of income in the form of freelance work or online gigs while you’ve been working from home? Now’s the time to get everything ironed out, so you can build a better plan.

Learn about Investing

The earlier you can start investing, the better. A lot of people make the mistake of thinking that they need to wait until they’re earning a huge income or preparing for retirement before they start to invest. However, the truth is actually that you can start making investments whenever you choose, and the results can be massive. If you’re brand-new to this landscape, start by building your education. Talk to a financial advisor about your options, and read up online about things like CFD trading, and Forex. There are plenty of ways to start building your wealth in 2021. Make sure that you invest in your future this year.

Invest in Yourself

Finally, it’s not just CFD opportunities and stocks that you should be spending your money on this year. This is also the perfect time to begin thinking about how you can invest in yourself. Can you open yourself up to more earning opportunities by learning a new skill or taking a course that earns you a valuable certification? Does it make sense to spend more of your time in this new year going to events that are relevant to your industry and tracking down opportunities to grow your career?

After a shaky year in 2020, the chances are that you’re already out of your comfort zone. That makes this the perfect time to start pursuing new opportunities and looking for new chances to grow. If you’re not sure how to start investing in yourself, make a list of the things you want to accomplish by the end of the year and start there. Where do you want to be 12 months from now, and what can you set in motion today to get you on the track to success?